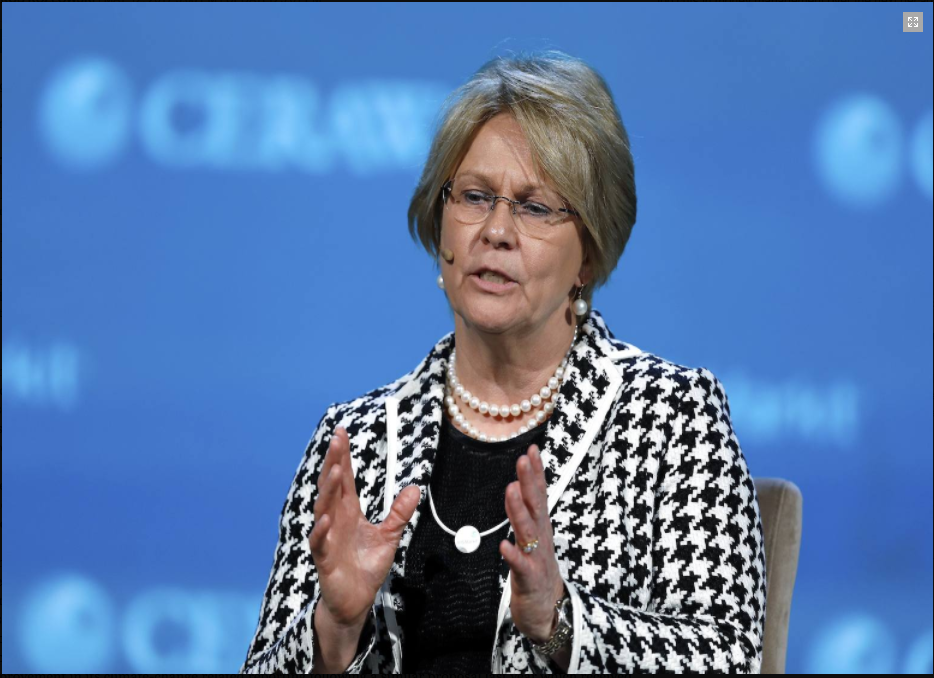

Vicki Hollub, president and CEO, Occidental Petrol

The California Public Employees' Retirement System's (CalPERS) climate risk reporting shareowner resolution, Proposal #5, passed today (13th May) at the annual shareowner meeting of Occidental Petroleum.

The resolution requires the international oil and gas company to report on environmental risks and opportunities associated with climate change. It was co-filed by CalPERS and other investors, including Wespath Investment Management, the Nathan Cummings Foundation, and the New York State and Connecticut pension funds.

"The passing of this resolution is a sign of progress. It is a first in the United States," said Anne Simpson, CalPERS investment director, sustainability. "The vote at Occidental demonstrates an understanding among shareowners that climate change reporting is an essential element to corporate governance. I believe that we will see many more companies move in this direction. This vote shows that investors are serious about understanding climate risk."

The proposal at Occidental Petroleum calls for an assessment of the company's portfolio under the "2 Degree Scenario." This assessment will include:

- Long-term impacts due to climate change

- Short and long-term financial risks of a lower carbon economy

- Evaluation of resources based on changes to demand and pricing

- Public policy positions relating to climate change

CalPERS believes companies should provide accurate and timely disclosure of environmental risks and opportunities associated with climate change. As outlined in CalPERS' Investment Beliefs (PDF), the System believes the effective management of environmental factors, including those related to climate change risk, increases the likelihood that companies will perform well over the long-term.

For more than eight decades, CalPERS has built retirement and health security for state, school, and public agency members who invest their lifework in public service. Our pension fund serves more than 1.8 million members in the CalPERS retirement system and administers benefits for nearly 1.4 million members and their families in our health program, making us the largest defined-benefit public pension in the U.S. CalPERS' total fund market value currently stands at approximately $320 billion. For more information, visit www.calpers.ca.gov.